In today’s complex business environment, the ability to effectively integrate various components of a portfolio is crucial to achieving strategic goals. Strategic portfolio integration methods provide a framework for aligning diverse business units, investments, and projects with overarching corporate objectives. These methods are not only pivotal for maximizing efficiency and productivity but also for ensuring that resources are allocated optimally. As companies strive for competitive advantage, understanding and implementing effective portfolio integration strategies becomes essential.

Read Now : Enduring Symbols In Fairy Tales

Understanding Strategic Portfolio Integration

Strategic portfolio integration methods are unique approaches designed to harmonize all aspects of a portfolio, ensuring that every element contributes to the overall strategic direction of the organization. By leveraging these methods, businesses can create synergies between departments, reduce redundancies, and enhance operational effectiveness. The core idea is to integrate resources, processes, and information seamlessly.

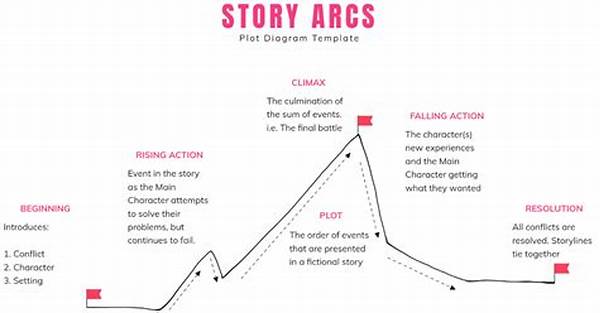

Organizations that succeed in this integration can expect improved decision-making processes as their strategies align with their operations. Strategic portfolio integration methods facilitate a comprehensive view of the entire portfolio, enabling leaders to make informed decisions about prioritizing projects and allocating resources efficiently. Through consistent evaluation and adaptation, these methods help in optimizing the return on investments, balancing risk, and ensuring steady progress towards strategic objectives. Furthermore, they allow organizations to remain agile, adapting to market changes swiftly while maintaining focus on long-term goals.

As businesses evolve, so too must their strategies for portfolio integration. The dynamic nature of market conditions necessitates continuous refinement of these methods to maintain relevancy and effectiveness. Engaging with strategic portfolio integration allows organizations to anticipate challenges, leverage emerging opportunities, and sustain growth over time.

Methods in Practice

1. Resource Alignment: Strategic portfolio integration methods ensure that resources are distributed effectively across projects. This guarantees that teams have what they need without wasting valuable assets.

2. Risk Management: By using strategic portfolio integration methods, organizations can identify potential risks early and develop plans to mitigate them, safeguarding the entire portfolio.

3. Performance Monitoring: These methods facilitate continuous assessment of projects, allowing adjustments that enhance performance and align with strategic goals.

4. Communication Enhancement: Effective integration methods improve communication across all departments, creating a unified approach to achieving company objectives.

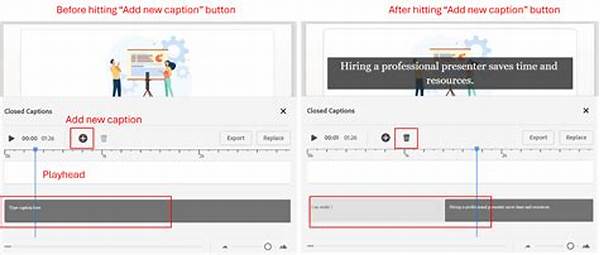

5. Technology Integration: Modern strategic portfolio integration methods often incorporate technological solutions to streamline processes and enhance data accessibility, ensuring cohesive operations.

Implementing Strategic Portfolio Integration

Strategic portfolio integration methods involve a systematic approach to assembling various components of a business portfolio to work in unison towards strategic goals. Implementation requires a clear understanding of the organization’s vision and a detailed analysis of its current processes and assets. By assessing these elements, companies can identify areas in need of integration and improvement.

Building on this foundation, organizations must create an action plan that outlines specific steps for integrating disparate systems and processes. Strategic portfolio integration methods demand collaboration across every level of the organization, fostering a culture of teamwork and shared purpose. Training programs and workshops can help employees understand the significance of these integration efforts and equip them with the skills necessary to contribute effectively. Moreover, the continuous monitoring and evaluation of integration practices ensure that they remain aligned with the organization’s strategic trajectory, allowing for modifications in response to changes in internal and external environments.

Key Considerations for Success

1. Clear Objectives: Establish clear goals for what the strategic portfolio integration methods aim to achieve, aligning them with the broader strategic vision.

2. Stakeholder Engagement: Successfully implementing strategic portfolio integration methods requires the involvement and buy-in of all key stakeholders.

3. Scalability: Ensure that methods are scalable, allowing the integration framework to grow and adapt alongside the business.

4. Data-Driven Approach: Utilize data analytics to inform strategic decisions, ensuring that integration efforts are based on solid evidence rather than assumptions.

5. Continuous Improvement: Embed a culture of continuous improvement within the organization to adapt and refine integration methods over time.

Read Now : Digital Marketing For Visual Artists

6. Leadership Support: Strong leadership is crucial for driving the successful application of strategic portfolio integration methods.

7. Technology Utilization: Leverage technology as a tool for enhancing integration efforts, making processes more efficient and effective.

8. Cultural Alignment: Ensure that integration efforts align with the organization’s culture to minimize resistance and enhance acceptance.

9. Risk Assessment: Regularly conduct risk assessments to identify and mitigate potential challenges in the integration process.

10. Performance Metrics: Establish metrics to evaluate the success of strategic portfolio integration methods and inform future improvements.

Maximizing Value Through Portfolio Integration

The underlying aim of strategic portfolio integration methods is to maximize the value derived from every project and investment within the portfolio. Through key practices such as resource optimization, risk management, and technological incorporation, businesses can unlock significant efficiencies and drive substantial value. Strategic portfolio integration methods not only streamline operations but also establish a clear direction for organizational growth.

As companies adopt these methods, they position themselves to navigate complex market landscapes effectively. By focusing on maximizing value through strategic portfolio integration, businesses can ensure that their efforts align with the company’s vision and mission. This integrated approach leads to enhanced innovation, improved market competitiveness, and a stronger alignment between current operations and future aspirations.

Moreover, strategic portfolio integration methods foster an adaptable and resilient business environment. By building a robust framework that accommodates change and encourages continuous improvement, organizations are better equipped to face uncertainties and capitalize on emerging opportunities. Consequently, strategic portfolio integration becomes a cornerstone of sustainable growth and long-term success.

Future Prospects and Innovations

As the business world continues to advance, the evolution of strategic portfolio integration methods will be vital for keeping pace with changing dynamics. Future innovations in this field may include greater reliance on artificial intelligence and machine learning to automate integration processes and enhance decision-making capabilities. Embracing emerging technologies can unlock new potentials within strategic portfolio integration methods, leading to even greater efficiencies and value creation.

Companies must remain alert to these changes and be prepared to integrate new developments into their strategies. The ability to adapt and innovate will determine the organizations that thrive in a competitive future landscape. By staying informed and proactive, businesses can leverage strategic portfolio integration methods not just to survive but to lead in their respective industries, achieving sustainable success and securing their position in the market for years to come.

Conclusion: Strategic Portfolio Integration

In summary, strategic portfolio integration methods serve as a powerful tool for aligning an organization’s projects and resources with its strategic objectives. These methods provide a framework for reducing waste, enhancing performance, and achieving growth. As businesses navigate the challenges and opportunities of the modern era, strategic portfolio integration becomes an indispensable element of comprehensive strategic planning.

Developing proficiency in these integration methods enables organizations to create cohesive and efficient systems that drive success. By fostering a culture of collaboration, continuous improvement, and innovation, companies can maintain a competitive edge in a rapidly evolving business landscape. As strategic portfolio integration methods continue to evolve, they will play an increasingly central role in shaping the future of business strategy.